Joining one of the many finance professional companies is one of the very best methods to gain a competitive edge. Financing expert organizations are non-profits whose mission is to serve the finance market and the interests of professionals in the financial sector. Joining a finance professional company presents an opportunity to find out, connect with experts in the field, and remain on top of the current trends in the market. A few of the most popular financing expert companies include: Signing up with a finance expert company is simple all you require to do is apply and pay the annual subscription charge. And the included authority can help maximize your degree for a finance significant wage.

Financing is a field lavish with excellent earning prospective and gratifying career choices in a broad variety of industries. The field has seen large growth despite current economic recession, so it's a bit more ensured than other fields. There are certainly more than five reasons why studying finance is a clever choice for prospective trainees, however we have actually assembled a list of the most relevant reasons to assist you decide which program of study is best for you! The reasons below touch on areas that are going to highlight perks for the career-driven individual who is looking to implement exciting modifications to their life in advantageous ways.

One terrific reason to end up being a finance significant is since of it's more narrow focus, however it still enables https://www.facebook.com/wesleyfinancialgroup/ you to check out a field that is dense with task chances. A finance degree enables you to work with the choice makers of outside organizations. Examples of these companies include: banks, federal government agencies, stockholders, providers, companies, and more. Having the ability to distinguish yourself with a financing degree will assist you when searching for tasks, especially from a big number of organization majors. As a finance degree is more difficult to attain, it's ensured to set you apart. Anyone can get an organization degree or do accounting, but in order to be in a finance career you should be outbound and analytical.

Therefore education, intelligence, and personality are all taken into consideration for finance jobs. Additionally, you should be diplomatic and consider your company's or client's goals, resources, and alternatives when discussing their options for financial development and well-being. According to The Bureau of Labor Data, due to a "growing series of financial products and the need for extensive understanding of geographic areas" financing positions are growing faster than the average for work in the United States. For instance, careers in financial analysis are to grow by 23 percent, monetary management by 14 percent, and financial advising by 32 percent. The chances will continue to present themselves as the economy continues to recover (What does ear stand for in finance).

As you can see above, finance careers are growing. This likewise means that the range of careers opportunities are growing too. With a finance degree you can work in: Corporate management International financial management Financial investment services Financial preparation services Personal financial preparation for individuals and personal organizations Brokerage firms Insurer Commercial and investment banks Credit unions and personal banks As well as many other financial intermediary business all utilize financing graduates. In addition to having a wide variety of task opportunities, the tasks that present themselves to you will also be really satisfying from an income perspective. Salary info differs from task title and experience, however the following are a couple of standard concepts of the average wage you can earn with a financing degree: The job market has actually underwent some large modifications in the past years, partly due to various technological innovations and partially due to the fact that of the economy.

The Basic Principles Of How Old Of A Car Will A Bank Finance

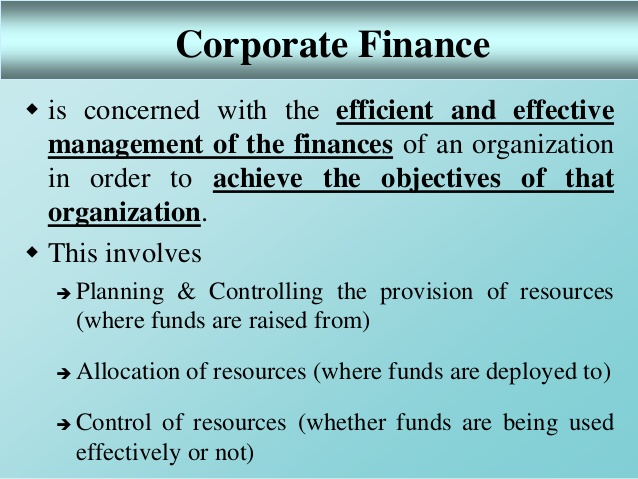

The required and elective courses you would take for majors vary significantly among institutions. Courses are noted here that are illustrative of the breadth of subjects you are most likely to experience were you to significant in this field (The trend in campaign finance law over time has been toward which the following?). Bonds Core Business Courses Corporate Finance Econometrics Economics Financial Reporting Governmental Financing Individual Financial Investment Monetary Institutions and Policy Portfolio Management Stats.

Careers in financing are highly desired due to their high pay and high development potential. Jobs for financial experts alone are expected to grow by 11% through 2026 according to the Bureau of Labor Statistics. However with these desirable positions comes a fiercely competitive field. The key to an effective financing career starts with getting your foot in the doorwhich suggests protecting an entry-level position. In this aricle we'll help you determine promising entry-level jobs for financing degree holders, and provide you insight into how you can take your profession to the next level as soon as you have actually landed an entry-level task.

Financial management professionals can expect to work for corporations and perform financial analysis for the company or work in the investment world (Which of the following approaches is most suitable for auditing the finance and investment cycle?). They might likewise work for the federal government to handle budgeting and analysis of costs. Financial planning experts work with people and families to manage their finances at the personal level, such as tax planning, debt management, investment strategy and more. Within these basic career courses are a multitude of jobs. Discovering a position begins with understanding what job titles to look for. Let's have a look at the most typical entry-level positions for financing graduates and the types of employers who employ them.

They examine the performance of stocks, bonds, and other types of investments to assist make the most of returns for their companies and clients. $57,728 (Payscale. com) $85,660 (BLS) Personal financial advisors deal with people to supply holistic advice on financial investments, insurance coverage, home mortgages, college savings, estate planning, taxes, and retirement to increase wealth and prepare for the future. $50,351 (Payscale) $88,890 (BLS) Loan officers function as the go-between for financial institutions and borrowers, helping assess, license, or advise approval of loan applications for individuals and organizations. $42,132 (Payscale) $63,040 (BLS) Budget plan analysts help public and https://www.linkedin.com/company/wesleyfinancialgroup private institutions arrange their financial resources by examining spending plans and determining the financial impact of institutional spending.